Based in Hong Kong, Shanghai, Bangkok, Cayman Islands & Prague, DS CAPITAL GROUP offers a unique service: fulfilling the interstitial space between the private equity and investment banking. Our principals come from traditional banking and finance background at some of the most storied names in the industry; we're innovative, knowledgeable and flexible. Our mission is to build trust and partnership with our clients to bridge the service and knowledge gap in investment banking - and for us to serve the advisory and capital needs of our clients.

Creating the future from our proud past to positively impact people lives

Real estate

Transport & Logistics

Energy & Infrastructure

Mining

DS CAPITAL issues securities (debt instruments or Certificates), and invests the proceeds in such a issuance in a development project

DS CAPITAL trades new issued securities to obtain financing through debt-based or equity-based securities

DS CAPITAL provides funding for projects against SBLC, Bank Guarantees and other banking instruments. DS CAPITAL monetize, trade and invest in projects

DS CAPITAL is able to grow your company by arranging Documentary letters of Credit (DLC) and Standby Letters of Credit for your suppliers. Our Documentary Letter of Credit financing allows you to focus on what important, growing your business.

DS CAPITAL provides to its clients full range of services linked to a Blockchain Technology. This enables new digital asset class, which has a crucial role in new Worldwide economy structures.

DS CAPITAL works with global experts for worldwide commodities trading whom can facilitate physical commodities trades.

Capital responds to the capital needs of our clients. Whether executing an IPO, a debt offering or a leveraged buyout, GCM integrates our expertise in Sales, Trading and Investment Banking to offer advice and sophisticated solutions. We originate, structure and execute public and private placement of a variety of securities: equities, investment-grade and non-investment-grade debt and related products.

We believe in responsible capitalism: alpha-generation and capital preservation guided by our principals of improving environmental, social, and governance. Therefore, ESG issues are of utmost importance to how we approach investment. We have set up an Advisory Group that connect global issues, such as climate change, water scarcity, or human rights, to the organization operations, strategy, and risk profile and the DS CAPITAL GROUP provides subject matter expertise for third party financial firms for best ESG practices, rating, and reports. We are the ESG experts in finance.

DS CAPITAL GROUP manages private funds that are aligned with our ESG objectives - including renewable energy. Our Investment Fund is one of the specialized funds that's formed under the PEF practice of DS CAPITAL GROUP.

GLOBAL MARKET PERSPECTIVES

We provide unique market perspective to our clients on specific sectors, and also the global macro landscape.

M&As

The DS CAPITAL GROUP M&A team excels in domestic and international transactions including acquisitions, divestitures, mergers, joint ventures, corporate restructurings, re-capitalization, spin-offs, exchange offers, leveraged buyouts and takeover defences as well as shareholder relations.

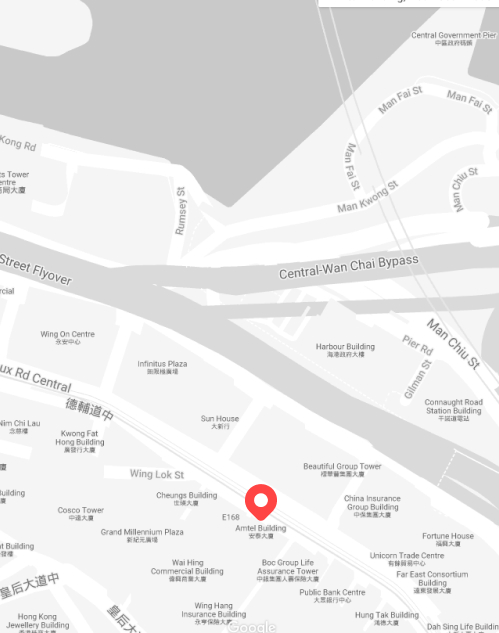

9th floor, Amtel Building

148 Des Voeux Road

Hong Kong s.a.r.

P.R. China

Email: reception@dscapitalgroup.com